The Week at a Glance

- Zero orders for cows and bulls. Southern German cows at €0.70/kg, bulls at €0.90/kg

- Price of Irish 36+ is €0.65/kg

- Dutch calf ranges between €3.50 and €4.50/kg

- Raw stock week 21. Sharp drop in work, some tanneries cut work shifts by half, others leave employees at home. Automotive under 30%, and worse for fashion and furniture. Requests to review already signed contracts.

- Currency market: $1.090/Euro, £0.894/Euro on 05/22

- Global – Consumption will start again with social shops

- Italy – Roberto Cavalli, transfer from Florence to Milan begins

- Italy – Mandarin bought ABC

- France – Dior requests patent for saddle bag

- Italy – Furniture’s Luxury Living Group sold to Lifestyle Design

- Italy – Cucinelli relies on a couple of CEOs

- Italy – Micam to be held in September

- France – Renault plans to close 4 French facilities

Click on a headline to go directly to that item

Click here to read this report in Italian

![]()

PRICE SURVEYS

Survey of UK and Irish Ox/Heifers

*UK prices in GBP, Irish Prices in Euros, delivered North Italian tannery, payment terms 30 days

| This Week | Last Week 05/15/2020 | |||

| OX/HFRS | UK | Ireland | UK | Ireland |

| 36.00 and up | 0.70-0.75 | 0.65-0.70 | 0.70-0.75 | 0.65-0.70 |

| 31.00 – 35.50 | 0.80-0.85 | 0.75-0.80 | 0.80-0.85 | 0.75-0.80 |

| 26.00 – 30.50 | 0.90-0.95 | 0.85-0.90 | 0.90-0.95 | 0.85-0.90 |

| 25.50 and under | 1.00 | 0.95-1.00 | 1.00 | 0.95-1.00 |

Survey of the European Cow Markets

*All prices quoted in Euros/kg. on 30/32kgs. delivered North Italian tannery, payment 30 days

| Cows | This Week | Last Week 05/15/2020 |

| N. German 25 kg and up | 0.45 | 0.45 |

| N. German 15-24 kg | 0.50 | 0.50 |

| S. German 40 kg and up | 0.70 | 0.70 |

| S. German 30-39 kilos | 0.65-0.70 | 0.65-0.70 |

| French Bretagne 32 kg and up | 0.85-0.90 | 0.85-0.90 |

| French Bretagne 32 kg and under | 0.80-0.85 | 0.80-0.85 |

| Central French 32 kg and up | 0.65-0.70 | 0.65-0.70 |

| Central French under 32kg | 0.60 | 0.60 |

| Italian | 0.30-0.35 | 0.30-0.35 |

| Dutch | 0.45 | 0.45 |

| Poland 26/27 kg* | 0.45-0.50 | 0.45-0.50 |

| Sweden* | 0.70 | 0.70 |

| Spain* | 0.55 | 0.55 |

| Finland* | 0.50 | 0.50 |

| Norway 17+ (av 24 kg)–* | ND | ND |

*delivered Northern Italian tanneries

| Heifers | This Week | Last Week 05/15/2020 |

| N. German 25 kg and up | 0.65 | 0.65 |

| N. German 15-24 kg | 0.70 | 0.70 |

| S. German 40 kg and up | 0.80-0.85 | 0.80-0.85 |

| S. German 30-39 kilos | 0.90 | 0.90 |

| S. German 24-30 kilos | 1.10 | 1.10 |

| S. German 15-24 kilos | 1.15 | 1.15 |

Survey of Dutch Veal Skin Market

*All prices quoted in Euros/kg. delivered North Italian tannery, payment 30 days

| Weight | This Week | Last Week 05/15/2020 |

| 14.5 kgs | 3.00-4.00 | 3.00-3.50 |

| 16.5 kgs | 3.50-4.50 | 3.30-3.60 |

Survey of French Veal Skin Market

*All prices quoted in Euros/kg. delivered North Italian tannery, payment 30 days

| Weight | This Week | Last Week 05/15/2020 |

| 13+ kgs (Luxury) | 5.50-5.80 | 5.80-6.00 |

| 13+ kgs (Black and White) | 4.50-5.00 | 4.50-5.00 |

| 8-12kgs (Luxury) | 4.60-5.20 | 4.60-5.20 |

| 8-12kgs (Black and White) | 4.00-4.50 | 4.00-4.50 |

Survey of Italian Veal Skin Market

| Weight | This Week | Last Week 05/15/2020 |

| 18kg and up | 2.50-3.00 | 2.50-3.00 |

| 18kg and under | 2.20-2.50 | 2.20-2.50 |

Survey of European Bull Markets

*All prices quoted in Euros/kg. delivered North Italian tannery, payment 30 days

| Origin | Avg. Green Wt. | This Week | Last Week 05/15/2020 |

| French – Central

French – Bretagne |

37 kilos and down

37 kilos and down |

0.85-0.90

1.00-1.05 |

0.85-0.90

1.00-1.05 |

| French – Central

French – Bretagne |

37 kilos and up

37 kilos and up |

0.90

1.05-1.10 |

0.90

1.05-1.10 |

| N. German | 30.0 – 39.0 kgs | 0.60-0.65 | 0.60-0.65 |

| N. German | 40.0 – 49.0 kgs | 0.65-0.70 | 0.65-0.70 |

| S. German | 40.0 – 49.0 kgs | 0.85 | 0.85 |

| S. German | 50.0 kilos and up | 0.90 | 0.90 |

| Benelux | 30.0 – 39.0 kgs | 0.60 | 0.60 |

| Benelux | 40.0 – 49.0 kgs | 0.65-0.70 | 0.65-0.70 |

| Italy | 40 kg and up | 0.50-0.55 | 0.50 |

| Spain | 40 kg and up | 0.70 | 0.70 |

| Poland* | 40 kg and up | 0.70 | 0.70 |

| Sweden* | 34 kg and up | 1.20 | 1.20 |

| Norway* | 34 kg and up | 1.75 | 1.75 |

| Finland* | 34 kg and up | 1.00-1.05 | 1.00-1.05 |

*delivered Northern Italian tanneries

Survey of Spanish Lamb/Sheep Markets

*Prices are ranged to reflect the different regions in Spain, from lower end to top end quality.

**Prices quoted basis fob origin on euros per piece basis (5.5-7ft range, 6.5ft avg.)

| Category | This Week | Last Week 05/15/2020 |

| Entre Fino doubleface | 11.00 | 11.00 |

| Entre Fino nappa | 10.50 | 10.50 |

| Merino doubleface | 11.50-12.00 | 11.50-12.00 |

| Merino 80/20 1st/2nds | 11.00 | 11.00 |

| Merino 2nds | 7.70 | 7.70 |

| Lachaune Lechal 90/10 % 1st/2nd | 6.50 | 6.50 |

| Lechal aprox 40% P+SP balance rasato | ||

| 100% 1st | 4.00 | 4.00 |

| 90/10 % 1st/2nds | 3.00 | 3.00 |

| Tigrados original | 1.50-2.00 | 1.50-2.00 |

Survey of United Kingdom Lamb/Sheep Markets

*Prices quoted in GBP/pce.

| Category | This Week | Last Week 05/15/2020 |

| Sheep skins | No Value | No Value |

| Hoggets | 0.00-0.50 | 0.00-0.50 |

| New season lambs | NA | NA |

Survey of Greek Lamb/Sheep Markets

*Prices quoted in USD/dz (pickled)

| Category | This Week | Last Week 05/15/2020 |

| Lamb skins (70/20/10) | 50 | 50 |

| Lamb skins (C2) | 30 | 30 |

Survey of New Zealand Lamb/Sheep Markets

*Prices quoted in USD/dz (pickled)

| Category | This Week | Last Week 05/15/2020 |

| Lamb skins (standard) | 55 | 70 |

| Lamb skins (C grade) | 20-25 | 15-20 |

Survey of Australian Markets

AUSTRALIA Wet blue, ox, USD/piece

| Grade A | This Week | Last Week |

| 6-14 kg | 15 | 15 |

| 14-18 kg | 25 | 25 |

| 18-23 kg | 36 | 36 |

| 23-27 kg | 45 | 45 |

| 27-31 kg | 53 | 53 |

| 31kg and up | NA | NA |

| Grade B | This Week | Last Week |

| 14-18 kg | 20 | 20 |

| 18-23 kg | 28 | 28 |

| 23-27 kg | 36 | 36 |

| 27-31 kg | 45 | 45 |

| 31kg and up | NA | NA |

| Grade C | This Week | Last Week |

| 14 kg | NA | NA |

| 14 -18 kg | NA | NA |

| 18-23 kg | 18 | 18 |

| 23-27 kg | 27 | 27 |

| 27-31 kg | 35 | 35 |

| 31 kg and up | 44 | 44 |

Survey of New Zealand Markets

NEW ZEALAND Wet blue ox, selection 80%-20%, USD/piece

| This Week | Last Week | |

| 20-24 kg | 50-51 | 50-51 |

| 24-27 kg | 60 | 60 |

| 27+ kg | 71-72 | 71-72 |

NEW ZEALAND Wet blue heifers, selection 80%-20%, USD/piece

| This Week | Last Week | |

| 14-18 kg | 40 | 40 |

| 18-23 kg | 50 | 50 |

NEW ZEALAND Wet blue cows, selection 80%-20%, USD/piece

| This Week | Last Week | |

| 14-18 kg | 28 | 28 |

| 18-23 kg | 34 | 34 |

Split report (wet blue)

*Prices quoted in $/kg.

| Origin | This Week | Last Week |

| USA | NA | NA |

| Brasil | NA | NA |

| Argentina | NA | NA |

![]()

RAW HIDE MARKETS ACROSS EUROPE

UK/Irish Ox/Heifers: Five cents less for Ireland

If last week Irish sellers could try to bring home €0.70/kg for the 36+, this week they can’t get more than €0.65. Irish hides are generally worth 10% less than English hides given the lower quality, but now the differential has essentially doubled. This is also due to the devaluation of the pound, which made British hides more competitive. A sale at €0.65/kg corresponds to 0.58 pounds in pounds sterling, while the same British hides sell around £0.70/kg. The same thing is happening to all other sizes as well.

Forecast

Complex weeks are expected for English sellers. Despite poor slaughter, demand is unable to absorb the entire availability of hides offered on the market and buyers expect, for some reason, a further drop in prices.

European Cows: No conclusions for German hides

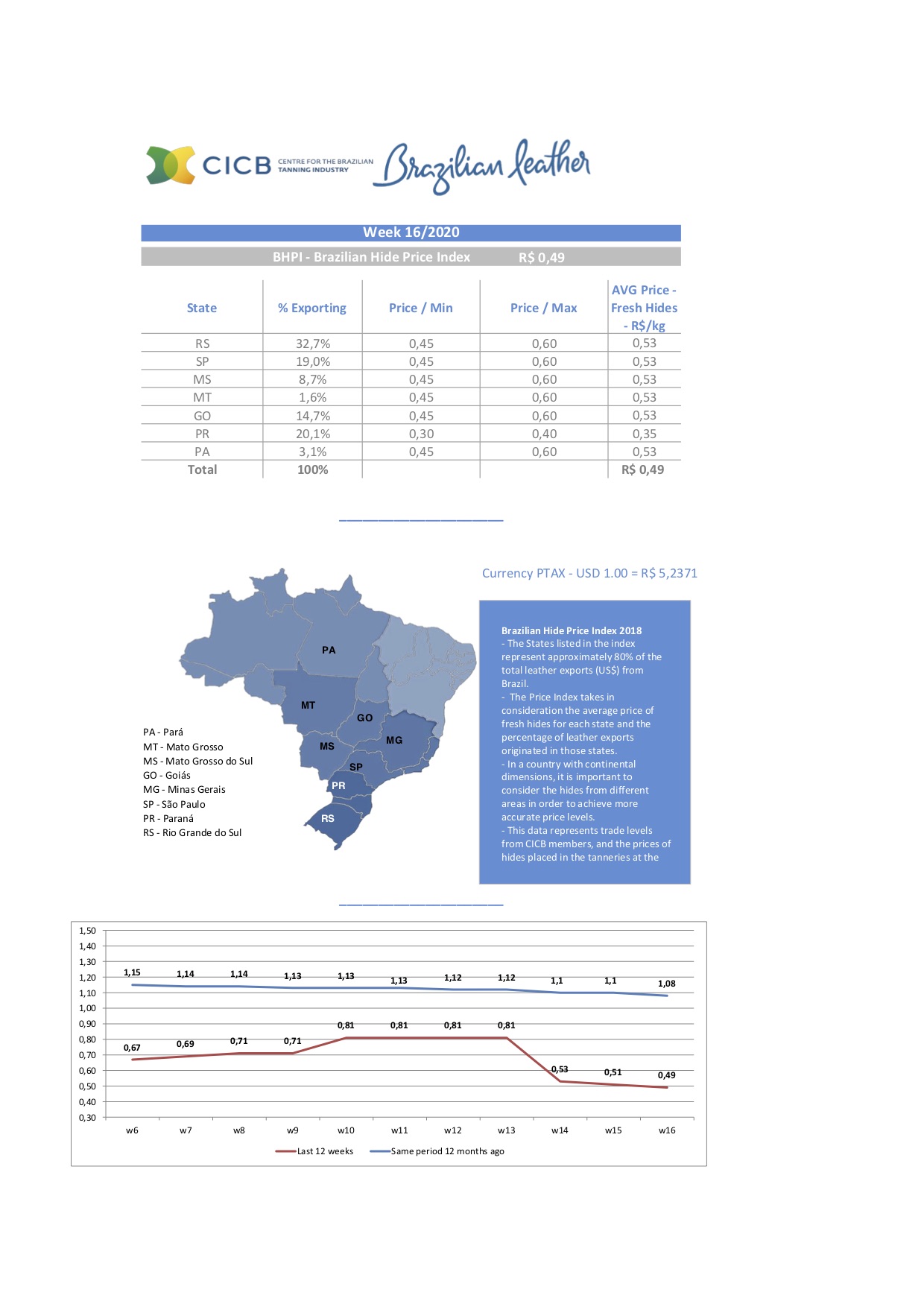

Prices are unchanged due to the absence of negotiations. Southern German cows, therefore, remain at the levels of last week, when they were sold at €0.70/kg, while the reference price for central French cows remains around €0.65. There is no demand for footwear, something has been produced for leather goods but it is a few if compared to February’s activity. In this situation, tanneries carry on with the initial stages of production but are unable to operate in the finishing phase, and therefore must manage some critical issues due to excess stocks of wet blue. Complicating the situation is the collapse in demand for furnishings from non-EU customers, on the one hand, and the sale of Brazilian Tr1 of more than moderate quality at $0.45/sf on the other.

Forecast

In addition to the drop in demand from the sofa factories, tanneries specializing in furniture must also face a lack of outlets for the residual materials destined for automotive steering wheels. The prospects for recovery are rather far off and prices could continue their decline.

Veal Skins: Netherlands up and down>

There are discussions about Dutch prices. Some sellers managed to tick the same price as Lineapelle, which is €4.50/kg, at a time when the price lists for cows have been halved compared to the February values. However, there are also rumors of contracts closed at €3.50, one euro less for the same origins. What is the right price? Both are fine. The difference not only depends on the quality level of the lot, which affects the evaluation, but also on the urgency of the sellers to close the contracts. In general, sellers have no urgency because few skins are available.

Forecast

Demand is reduced, like supply. The strongest position continues to be that of those who sell, because the average quality of European calves in the spring harvest is high and functional for the production of top leather goods. We expect stability for prices, with a gap between minimums and maximums, however high.

European Bull Market: No sales

This has been a very bad week. No sales, requests for postponed delivery, pessimism and distrust on the part of the tanneries: This is the climate around which the bull game was played. We confirm last week’s prices: €0.65-0.70 for large sizes from northern Germany, €0.90 for the best grades in southern Germany, €0.65/kg in the Netherlands, €0.70 in Poland, central France at €0.90 and Italian bulls at €0.50-0.55/kg.

Forecast

Sellers have no intention of giving in on prices. Current prices certainly do not satisfy them, and furthermore, there has been an additional drop in slaughter especially in Germany, mostly linked to problems with contagion in some slaughterhouses. The drop in demand, or rather the failure to restart it, in the automotive sector acts as a counterweight. The sum of two weaknesses should allow prices to remain stable.

Lamb and Sheep Market: Deliveries just for old orders

The skin economy is living in a period called “disorienting” by operators. European tanneries are carrying on production linked to some orders that arrived before the forced closures, but there are no signs of new orders and the prospects are far worse than those at the present. The orders, which in this area are mostly made through warehouses of imported skins, are limited to a few high-quality lots. Meanwhile, for the medium and medium/low range, it is complete darkness. If sheepskin tanneries are operating below 50% capacity, for goat specialists the work is practically zeroed.

Forecast

By now even the most optimistic seem resigned to the idea that the real restart will not happen before August-September. The month of August in Italy could become a month of work to compensate for a part of spring losses. From then on, it will be necessary to see who will be able to resist the crisis. However, prices are not destined to drop significantly.

![]()

REFLECTIONS OF THE WEEK

Raw stock week 21. Sharp drop in work, some tanneries cut work shifts by half, others leave employees at home. Automotive under 30%, and worse for fashion and furniture. Requests to review already signed contracts.

That the restart would have been difficult, one could already imagine. The reality of the facts turned out to be in line with expectations, and for some, even worse. In Arzignano, the leading leather district in Europe, several tanneries have chosen to undertake a partial restart, halving working hours or, in other cases, operating only three days a week instead of five or six, as was the case before the crisis. In addition, the layoff used during the lockdown has returned and several companies are using it. Across Europe, the moment is complicated because leather for footwear and leather goods has no orders. Furniture depends heavily on the United States and the automotive industry has reduced orders by a further 30% at this time compared to the already reduced pace of the first two months. The most significant tensions this week are related to furnishings because there are realities, especially in Arzignano, which are affected by the crisis that hit HTL in Singapore. This is a crisis that has reduced orders, although there should be no bankruptcy complications because the most exposed company belongs to an investment fund and therefore enjoys excellent financial health. However, it certainly is an additional destabilizing element in an already critical overall situation. Thus, for furnishings, all tanneries linked to non-EU orders (China, Thailand, USA, Canada) are faced with a zeroing of orders which certainly cannot be compensated for by the high-quality Italian sofa producers, who in turn are suffering because of their lack of retail customers. Coming to prices, the situation is basically stable with some possibility of obtaining discounts (maximum 5 cents) in case of orders. But the result of the past week has been almost zero. If something had been done in the previous week, there were no contracts in the one just ended. On the contrary: The only relevant fact is the request to postpone the deliveries of purchases that were concluded during Lineapelle, with some tanneries forced to ask for a price review because, in turn, the tannery was asked to review the contracts signed by its customers.

The difficult availability of skins

Sheep prices have decreased, but the drop is much more contained than that recorded for cows in the post-Lineapelle period. The reasons are clear enough. First of all, for European origins, the drop in slaughter was particularly high because restaurants are the prevalent destination for sheep-meat, so there was little demand for skins but also little supply. In addition, shipments to Europe have slowed down from Iran and therefore Iranian skins are few or, in some cases, because of the cheaper grades, are not delivered, because there is no demand for low grades in Europe. The least affected by the downturn are Southern African origins, which are also hardly available due to the effect of the production lockdown. Then there is a rather important problem that affects Nigeria. Some luxury brands, in particular those of the Kering Group, reportedly have decided not to purchase this origin, as the country is on a blacklist. This fact could push demand toward more western nations, such as the Ivory Coast or Burkina Faso, depressing Nigerian prices, which have already fallen for the best grades, while the lower grades no longer have a market in Europe.

Upcoming European Trade Show Events

| PITTI UOMO | Florence, Italy | POSTPONED September, 2020 |

| EXPO RIVA SCHUH | Riva del Garda, Italy | CANCELED |

| FREIBERG LEATHER DAYS | Freiberg, Germany | CANCELED |

![]()

INDUSTRY NEWS

World – Consumption will start again with social shopping

Zuckerberg goes to meet small businesses by launching his Facebook shop. The closure of physical stores has pushed many to try bringing their business online and according to Technavio, the London-based research firm, by 2021 the social commerce market will reach a turnover exceeding $165 billion. Hence, the idea of making shopping more immediate, allowing anyone, from the small business owner to the global brand, to use the app of the famous social network to connect with their customers, investing in new features that can inspire people in their shopping while making online commerce easier. Designed to help companies create a single online store, which customers can access on both Facebook and Instagram, Facebook shops are simple and free. Companies can choose the products they want to include in their catalog and customize the look and feel of the shop with a cover image and colors that reflect their brand. This means that any entrepreneur, regardless of the size of his company or budget, can bring his business online and connect with customers where and when they prefer. Facebook shops will be available on a company’s Facebook page or Instagram profile, but also in stories or advertisements starting in the coming months.

Italy – Roberto Cavalli begins transfer from Florence to Milan

The management of the Roberto Cavalli fashion house has officially notified the unions that it will transfer to Milan of its Sesto Fiorentino headquarters, including the 170 employees. It aims to close the facility starting with September, according to the ANSA agency. “In the digital and COVID-19 era, the new Roberto Cavalli is the only company in the country that thinks it is strategic to transfer 170 families from Florence to Milan, because the management of digital services is there,” said the secretaries of trade unions Femca-CISL and Filctem-CGIL Firenze, Mirko Zacchei and Luca Barbetti. “We believe, although we are not entrepreneurs, that all companies are saying the opposite: Thanks to digital technology, and for the needs induced by this particular situation, the value and importance of remote work is being valued.” The company had also anticipated its intention to guarantee to all workers the treatments, terms and conditions provided for by the relative national collective contracts transfers, giving full continuity to all employment relationships.” The company’s plan is based on a clear strategic direction, namely that Roberto Cavalli has today and will increasingly have a prevalent commercial vocation in the future. The decision to aggregate all the commercial and administrative functions at the Milan office is therefore primarily physiological: The city is the reference point for national and international investors and customers,” said Cavalli.

Italy – Mandarin bought ABC

Creating an Italian hub of suppliers for luxury companies is the objective of the private equity fund Mandarin Capital. Through its subsidiary Margot, it has completed another acquisition, ABC Morini, a Scandicci-based company with more than 50 years of history that specializes in accessories for leather goods. Mandarin Capital Partners III bought Eurmoda last November. The closing of the transaction led to the creation of the Margot holding company (which Eurmoda controls), which is controlled 70% by the fund and 30% by Marco Vecellio, formerly CEO of Eurmoda. Just in November, with the Eurmoda deal, Andrea Tuccio, partner of Mandarin Capital Partners III, explained that, “the idea is to invest in complementary small and medium-sized enterprises, which often work with the big brands, and to make them grow nationally and internationally, also focusing on new technologies.”

France – Dior requests patent on its Saddle bag

Twenty years after its launch, Dior turns to the US Patent and Trademark Office to register the design of the iconic ‘Saddle’ bag. The request includes the configuration of the product — its particularly recognizable shape — that identifies and distinguishes the bag introduced by John Galliano during the S/S 2000 season when he was creative director of the house. The Saddle bag was brought back to the fore by Maria Grazia Chiuri, at the helm of the brand since 2016, who proposed it again starting from the F/W 2018-19 collection adding new details, prints and materials to the accessory that incorporates the profile of a saddle. The Italian designer has also reintroduced the characteristic oblique pattern with the logo of the fashion house created by Marc Bohan in 1967 (creative director from 1961 to 1989), combined precisely with the Saddle.

Italy – Furniture, Luxury Living Group sold to Lifestyle Design

Haworth Inc, through its Lifestyle Design division (which includes brands such as Poltrona Frau, Cassina, Ceccotti, Cappellini, Janus, Karakter, for the retail division Luminaire and Dzine), has reached an agreement to acquire 100% of Luxury Living Group (LLG). The closing of the transaction, which awaits antitrust approval, is scheduled for the end of June. The aim of the deal is to restore strength to the company that has produced and distributed licensed products for international luxury brands for 30 years, including Bentley Home, Trussardi Casa, Bugatti Home and Fendi Casa, which represents more than half of the turnover of the LLG group. Once the acquisition process is complete, the first projects planned for the following semester will be the reopening of the completely renovated Paris showroom, the reopening of the London space and the finalization of the opening in San Francisco. Haworth’s commitment will be to restore LLG’s economic/equity balance through a structured debt reduction process. LLG will maintain its independence as management will be confirmed in the figures of Roberto Spada president, Olga Vignatelli vice president, and Renato Preti, chief executive officer. The management will be assisted by the Lifestyle Design team which, under the leadership of CEO Dario Rinero, has grown in the past ten years to exceed a turnover value of over €500 million.

Italy – Cucinelli relies on a couple of CEOs

Last year, Brunello Cucinelli communicated his intention to take a step back from the role of CEO of the Umbrian brand of high-end clothing and accessories for men, women and children that he founded in 1978. Now, the renewal of corporate positions was ratified at the shareholders’ meeting that approved the 2019 financial statements. The Italian entrepreneur will now be joined by two co-CEOs. At the meeting, the newly-elected 12-member Board of Directors conferred responsibility for style, creativity and communication to Executive Chairman Brunello Cucinelli, confirming him in the role of Creative Director, and appointed Luca Lisandroni and Riccardo Stefanelli as new Chief Executive Officers, making Luca Lisandroni the head of Markets and Riccardo Stefanelli of Products and Operations. Stefanelli is the husband of the entrepreneur’s eldest daughter, Camilla Cucinelli, and has 14 years of experience within the company, while Lisandroni joined the company 4 years ago, coming from Luxottica.

Italy – Micam to be held in September

The international footwear exhibition Micam confirms the dates of its September edition, which will take place from 20 to 23 September at Fiera Milano Rho. It also communicates the desire to start again, which emerged from a survey commissioned to test the mood and needs of the sector in the post coronavirus period. “In a moment of great uncertainty for our sector due to the current global health crisis, we have listened to the needs of companies and buyers and we are ready to be by their side to start again,” said Tommaso Cancellara, CEO of Micam and General Manager of Assocalzaturifici. “The operating machine is already at work and the September edition will be a fundamental event for everyone to re-establish ties with the market and create new opportunities in total safety. We are also negotiating and defining a commercial agreement with one of the most important players in the world in digital services, to offer all Micam exhibitors a new B2B digital sales channel. We will divulge more details in the coming weeks.”

France – Renault plans to close 4 French facilities

Renault is considering closing four factories in France under its new business plan which will be presented in late May. According to several newspapers, three small plants and especially the historic Flins factory just outside Paris, are at risk. The closures, still under discussion and therefore not entirely definitive, would fully fall within the strategic plan, which will be unveiled on May 29 and will include the objective, already indicated in February by the interim CEO, Clotilde Delbos, of generating cost savings of at least €2 billion by 2022. The downsizing program should begin with the Choisy-le-Roi component plants (in the suburbs of Paris) and Caudan (Brittany) in the first phase and the Dieppe plant (Upper Normandy) dedicated to Alpine models. Within a few years, Flins will have the same fate, and in this case the decision will concern a plant that, together with the production complexes of Volkswagen in Wolfsburg and Fiat in Mirafiori, has made the history of the European automotive sector.

We remind readers that all price tables that we drafted are intended as a basis to illustrate the trends. Our prices quoted do not reflect quality changes present between one and the other source. Hidenet.com recognizes that there is a variety of factors able to determine different prices for similar materials.

The Leather and Hide Council of America (LHCA) has warned that the phenomenon of cattle hides going to waste rather than being made into leather will continue in 2020.

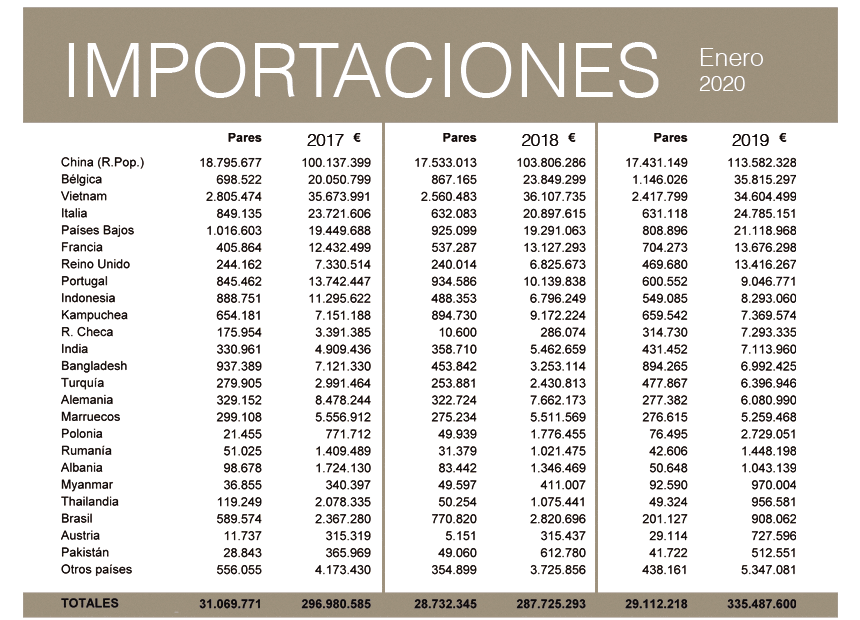

The Leather and Hide Council of America (LHCA) has warned that the phenomenon of cattle hides going to waste rather than being made into leather will continue in 2020. The Spanish tanning sector sells more than half of its annual leather production abroad. Last year alone, national exports of semi-tanned and tanned leather generated a total of more than €578 million. Imports of hides and leather in 2019 amounted to €461.5 million. If we analyze the evolution of both exports and imports of hides and leather in our country during the last decade, we find that throughout these 10 years, Spain has always sold more raw hides than it bought abroad, contrary to what has happened with semi-tanned hides, whose imports have always been much higher than exports. As for tanned leather, it is noted that only since 2016 sales of this type of leather exceed purchases.

The Spanish tanning sector sells more than half of its annual leather production abroad. Last year alone, national exports of semi-tanned and tanned leather generated a total of more than €578 million. Imports of hides and leather in 2019 amounted to €461.5 million. If we analyze the evolution of both exports and imports of hides and leather in our country during the last decade, we find that throughout these 10 years, Spain has always sold more raw hides than it bought abroad, contrary to what has happened with semi-tanned hides, whose imports have always been much higher than exports. As for tanned leather, it is noted that only since 2016 sales of this type of leather exceed purchases. Carlos Paz, head of the National Service for Agrifood Health and Quality (Senasa), has sent a note to tanneries requesting that they resume the normal flow of hide removal, or “the corresponding measures will be taken to guarantee it.”

Carlos Paz, head of the National Service for Agrifood Health and Quality (Senasa), has sent a note to tanneries requesting that they resume the normal flow of hide removal, or “the corresponding measures will be taken to guarantee it.” Born in Monóvar (Alicante) in 1927, Silvino Navarro earned a degree in chemical engineering before spending a long career in the leather sector. In 1952 he founded the company Industrias del Curtido (Incusa) in Silla, Valencia. It is one of the most important tanneries in Spain, specializing in tanning cowhides with full-grain, nubuck and patent leather finishes. Years later, in 1972, he continued with Dercosa, specializing in the production of split cowhide for shoes, belts and leather goods. Finally, in 1991, he started up Tenerías Omega, a tannery currently considered one of the main European suppliers of leather for the automotive, domestic upholstery and aviation sectors.

Born in Monóvar (Alicante) in 1927, Silvino Navarro earned a degree in chemical engineering before spending a long career in the leather sector. In 1952 he founded the company Industrias del Curtido (Incusa) in Silla, Valencia. It is one of the most important tanneries in Spain, specializing in tanning cowhides with full-grain, nubuck and patent leather finishes. Years later, in 1972, he continued with Dercosa, specializing in the production of split cowhide for shoes, belts and leather goods. Finally, in 1991, he started up Tenerías Omega, a tannery currently considered one of the main European suppliers of leather for the automotive, domestic upholstery and aviation sectors.

Tempe, the footwear design, manufacturing and distribution subsidiary of Inditex, closed the last fiscal year with a growth of 6%, reaching €1,400 million.

Tempe, the footwear design, manufacturing and distribution subsidiary of Inditex, closed the last fiscal year with a growth of 6%, reaching €1,400 million. Yue Yuen Industrial (Holdings) Ltd. reported revenue of $10,105.4 million in 2019, an increase of 4.2 percent compared with the previous year. Profit attributable to owners of the company was down by 2.1 percent to $300.5 million, as compared to $307.1 million recorded for the previous year.

Yue Yuen Industrial (Holdings) Ltd. reported revenue of $10,105.4 million in 2019, an increase of 4.2 percent compared with the previous year. Profit attributable to owners of the company was down by 2.1 percent to $300.5 million, as compared to $307.1 million recorded for the previous year. Rocky Brands, Inc. announced that it would continue operations and shipments from its distribution center in Logan, Ohio following Ohio Gov. Mike DeWine and the Ohio Department of Health issuing a “Stay at Home” order for all nonessential businesses from March 24 through April 6, 2020.

Rocky Brands, Inc. announced that it would continue operations and shipments from its distribution center in Logan, Ohio following Ohio Gov. Mike DeWine and the Ohio Department of Health issuing a “Stay at Home” order for all nonessential businesses from March 24 through April 6, 2020. The Italian Footwear Manufacturers Association (Assocalzaturifici) said it remains operational and is offering help and support to members who are encountering commercial difficulties, including juridical assistance.

The Italian Footwear Manufacturers Association (Assocalzaturifici) said it remains operational and is offering help and support to members who are encountering commercial difficulties, including juridical assistance. While the European stores of global player Ecco remain closed, shoe production in China is starting up again.

While the European stores of global player Ecco remain closed, shoe production in China is starting up again. Steven Madden Ltd. has become the latest footwear company to announce furloughs and pay cuts as coronavirus pandemic measured continue to hit the retail sector.

Steven Madden Ltd. has become the latest footwear company to announce furloughs and pay cuts as coronavirus pandemic measured continue to hit the retail sector.

During the first month of 2020 (before the coronavirus crisis began in Spain), sales of Spanish footwear abroad grew both in terms of value and volume. For their part, imports also increased at the beginning of the year.

During the first month of 2020 (before the coronavirus crisis began in Spain), sales of Spanish footwear abroad grew both in terms of value and volume. For their part, imports also increased at the beginning of the year.

Reuters has reported that Ferrari will extend the shutdown of its two Italian plants and reopen on April 14, provided it has supplies, and update 2020 forecasts in May when it releases its first-quarter earnings.

Reuters has reported that Ferrari will extend the shutdown of its two Italian plants and reopen on April 14, provided it has supplies, and update 2020 forecasts in May when it releases its first-quarter earnings. French carmaker Renault has halted production at all its plants across the world, except in China and South Korea.

French carmaker Renault has halted production at all its plants across the world, except in China and South Korea. Italian leather upholstery and home furnishings manufacturer Natuzzi S.p.A. has applied to the Securities & Exchange Commission for relief on filing requirements for its fiscal year ended Dec. 31.

Italian leather upholstery and home furnishings manufacturer Natuzzi S.p.A. has applied to the Securities & Exchange Commission for relief on filing requirements for its fiscal year ended Dec. 31. A date change from March to February paid off for Eastern Europe’s largest furniture trade show, Meble Polska, last month.

A date change from March to February paid off for Eastern Europe’s largest furniture trade show, Meble Polska, last month. In Italy and France, Chanel is paying full salaries to employees. The French group’s decision is valid for eight weeks and covers 750 Italian employees, according to Pambianco News. This encompasses workers in production plants as well as logistics and coordination centers.

In Italy and France, Chanel is paying full salaries to employees. The French group’s decision is valid for eight weeks and covers 750 Italian employees, according to Pambianco News. This encompasses workers in production plants as well as logistics and coordination centers. Louis Vuitton owner LVMH said on Friday it could “accurately” calculate at this stage the impact of the closures of production sites and stores linked to the global coronavirus pandemic. The French luxury goods group issued a short statement that it will publish its sales figure for the first quarter on April 16, after the close of the Paris market.

Louis Vuitton owner LVMH said on Friday it could “accurately” calculate at this stage the impact of the closures of production sites and stores linked to the global coronavirus pandemic. The French luxury goods group issued a short statement that it will publish its sales figure for the first quarter on April 16, after the close of the Paris market. Prada Group warns that the coronavirus pandemic has “interrupted” its growth. Net revenues for the group, including both Prada and Miu Miu, rose by 2.7% to £2.9 billion for 2019.

Prada Group warns that the coronavirus pandemic has “interrupted” its growth. Net revenues for the group, including both Prada and Miu Miu, rose by 2.7% to £2.9 billion for 2019. Pittards, the British leather and luxury goods manufacturer, reported revenue of £22.3m in its final results for 2019, down from £28.5m year-on-year.

Pittards, the British leather and luxury goods manufacturer, reported revenue of £22.3m in its final results for 2019, down from £28.5m year-on-year. The COVID-19 pandemic is all anyone can talk about and rightly so. It has changed life and business across the globe. That said, it’s vital to keep promoting the leather industry, even at this uncertain time in our lives. This morning, Leather Naturally held its annual meeting, which itself was a product of our new environment: a virtual annual meeting.

The COVID-19 pandemic is all anyone can talk about and rightly so. It has changed life and business across the globe. That said, it’s vital to keep promoting the leather industry, even at this uncertain time in our lives. This morning, Leather Naturally held its annual meeting, which itself was a product of our new environment: a virtual annual meeting.