The Week at a Glance

- Brazilian prices unchanged

- Argentina: Footwear, tanning, leather goods production all grew in January

- Brazil’s February hide exports lower in value and volume

- Brazil’s 2022 cattle slaughter increased by 7.5%

- “Asian invasion” affecting employment in Brazilian footwear sector

- Chile: Retail imports low, but clothing and footwear higher in 2022

- Cúcuta and Brazil cooperate to innovate in the footwear industry

- Santiago de Cuba footwear industry seeks investment from China

- SAPAL closed 93 companies, 90% of which were tanneries

Click here to read the report in Spanish

![]()

Raw/Fresh Skins

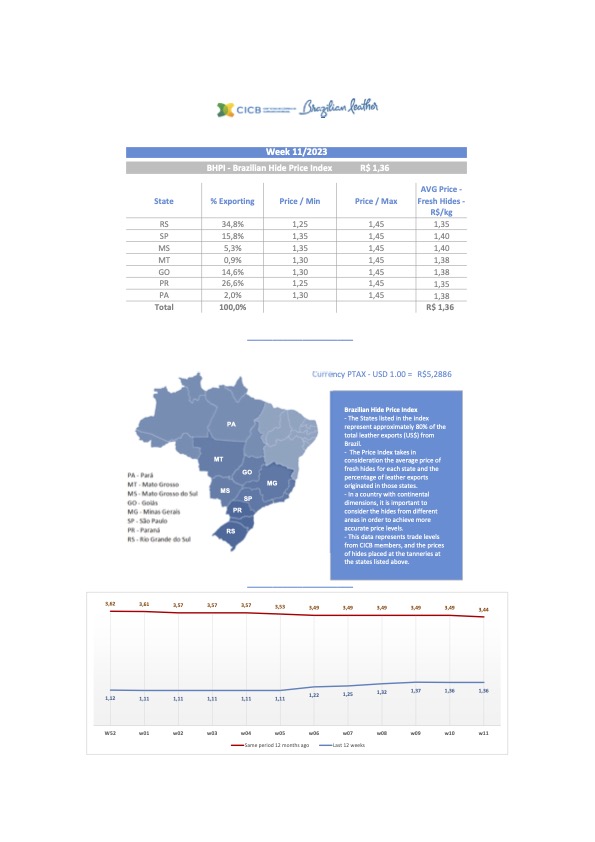

This week in Brazil, the real closed the week at R$5.2886 against the US dollar compared to R$5.1347 in the previous period. The average price of fresh hides was unchanged R$1.36 per kg. In terms of raw material, there is pressure to raise the price of a kilo of fresh hides in Brazil. However, due to the low demand for leather, the volume of raw material is enough to meet sector demand, so there is no reason to increase the price.

Zebu hide prices remain unchanged, selling for R$1.25 to $1.404/kg (with hump). Gaucho hides were likewise steady at R$1.20 to $1.40 kg (without hump).

In the cattle and raw material market, the physical market for live cattle had higher prices in most of the Brazilian livestock markets because of shorter slaughter schedules. Although there is great caution in cattle purchases, advances in slaughter schedules are due to readjustments in the indications of arroba prices. In general, the slaughter schedules of Brazilian slaughterhouses serve, on average, 5 days.

Inside the gates, the good pasture conditions allow the ranchers to also wait for news regarding China, which still maintains the embargo on Brazilian beef due to the atypical case of “mad cow” in Pará. Even with the lower trading volume, live cattle futures contracts are already close to the R$300/@ level, especially for the Oct/23 maturity. The quotations of fat cows and heifers fell by R$ 3/@, to R$ 257/@ and R$ 267/@, respectively (gross and forward values). However, São Paulo fat cattle are still worth R$ 277/@, on time, gross price.

Note: 1 arroba = 15kg = 33 lbs

![]()

Wet Blue & Crust

Brazil’s domestic market sales market are very calm, with buyers still waiting for better demand and prices.

With regard to export sales, global demand remains low and prices under pressure. Revenues of just US$75.4 million in Brazilian leather exports in February reflect weak demand in the global market.

The reference price of TR1 remains at US$0.70 per square foot, extra heavy at $0.76. The devaluation of the real improved trading conditions for negotiating prices and pushing new contracts. Some may be a few cents lower than the guideline, perhaps US$0.02 to US$0.03. Split prices remain under pressure due to the lack of hides.

Signs are that the expected market recovery in Europe and Asia should take place soon. In this sense, this improvement already has positive reports in China.

![]()

PRICES IN BRAZIL

WEEKLY PRICES PER US$/CFR (except raw material)

| FRESH HIDES US$/Kg | This Week | Last Week |

| US$0.26 | US$0.26 |

| WET BLUE WHOLE HIDES FULL SUBSTANCE | This Week | Last Week |

| Grade TR1 23Kgs+ | 0.70 | 0.70 |

| Grade TR2 22Kgs+ | 0.62 | 0.62 |

| Grade TR3 21Kgs+ | 0.54 | 0.54 |

| Grade TR4 19Kgs+ | 0.44 | 0.44 |

| WET BLUE WHOLE HIDES 20 mm+ | ||

| Grade TR1 47/52ft | 0.60 | 0.60 |

| Grade TR2 47/52ft | 0.52 | 0.52 |

| Grade TR3 45/50ft | 0.44 | 0.44 |

| Grade TR4 45/50ft | 0.34 | 0.34 |

| WET BLUE SIDES 24mm+ | ||

| Grade AB 22/26ft | 0.60 | 0.60 |

| Grade C 22/26ft | 0.52 | 0.52 |

| Grade D 22/26ft | 0.44 | 0.44 |

| Grade E 20/26ft | 0.40 | 0.40 |

| Grade F 20/26ft | – | – |

| WET BLUE SPLITS* | ||

| 6/9 Kgs (Glove standard) | 0.65 | 0.65 |

| 7/10Kgs | 0.85 | 0.85 |

| 10/12Kgs | 0.95 | 0.95 |

| 14 kg+ | 1.00 | 1.00 |

| CRUST ( UPHOLSTERY ) 9/11 mm Stucco & Buffed | ||

| TR 01 | 0.95 | 0.95 |

| TR 02 | 0.85 | 0.85 |

| TR 03 | 0.75 | 0.75 |

| CRUST ( AUTOMOTIVE O&M ) 11/13 mm | ||

| TR 01 | 1.20 | 1.20 |

| TR 02 | 1.10 | 1.10 |

| TR 03 | 1.00 | 1.00 |

| CRUST ( AUTOMOTIVE O&M ) 11/13 mm | ||

| TR 01 Vacuum Dry | 1.25 | 1.25 |

| TR 02 Vacuum Dry | 1.15 | 1.15 |

| TR 03 Vacuum Dry | 1.05 | 1.05 |

| CRUST SIDES FOR SHOE UPPER BLACK DYED THRU | ||

| ABC 12/14 mm 14/16 mm | 0.88 | 0.88 |

| D 12/14 mm 14/16 mm | 0.86 | 0.86 |

PRICES IN ARGENTINA

| ARGENTINA | This Week | Last Week | |

| Raw hides (W/S) | |||

| Steers | $0.43 | $0.43 | |

| Cows | $0.29 | $0.29 | |

| Heifers | $0.48 | $0.48 | |

| Crust for shoe upper, 1.2/1.4 mm, black dyed thru* | ABC | 1.80 | 01.80 |

| CDE | 1.45-1.50 | 1.45-1.50 | |

| Crust whole hides for upholstery 0.9/1.1 mm** | Auto | 1.20-1.40 | 1.20-1.40 |

| Furniture | |||

| Wet blue drop splits, average 9/11 kg, selection TR*** | Auto | 1.20-1.30 | 1.20-1.30 |

**Usually for full grain selections.

*The selection composition determines the price.

Uruguay’s prices unchanged

Prices remained stable again this week but are under pressure.

| SALTED | US$23.00 per hide/28 kg FOB |

| FRESH | US$0.50 per kilo |

| WET BLUE 14/16 AB | US$0.90 |

| WET BLUE 14/16 TR01 | US$0.65 |

| WET BLUE 14/16 TR02 | US$0.55 |

| WET BLUE 14/16 TR | US$0.70 (AB/TR1/TR2 = 30/40/30) |

| CRUST 10/12 TR01 | US$1.05 |

| CRUST 10/12 AUTO | US$1.45 |

| CRUST 10/12 AUTO | US$1.55 (Vacuum Dry) |

We remind readers that all price tables are intended as a basis to illustrate trends. Our quoted prices do not reflect quality changes between one source and the other. Hidenet.com recognizes that there is a variety of factors able to determine different prices for similar materials.

![]()

Colombian prices steady

Prices and demand were steady this week, but again under pressure.

| Salted | 26/28 kg | US$0.40/kg |

| Salted | 30/32 kg | US$0.50/kg |

| WB | TR1/TR2 20/22mm+ | US$ 0.42 per sq ft |

| WB | TR3 | US$ 0.34 per sq ft |

We remind readers that all price tables are intended as a basis to illustrate trends. Our quoted prices do not reflect quality changes between one source and the other. Hidenet.com recognizes that there is a variety of factors able to determine different prices for similar materials.

![]()

Chile’s market prices flat

Chile’s market prices remain unchanged but suppliers expect increases soon.

| TR1 | USD 0.80 (full substance | US$0.70 16mm+ |

| TR2 | USD 0.70 (full substance) | US$0.60 16mm+ |

| TR3 | USD 0.60 (full substance) | US$0.50 16mm+ |

We remind readers that all price tables are intended as a basis to illustrate trends. Our quoted prices do not reflect quality changes between one source and the other. Hidenet.com recognizes that there is a variety of factors able to determine different prices for similar materials.

INDUSTRY NEWS

ARGENTINA

Footwear, tanning, leather goods production all grew in January

Argentina’s production of footwear and its parts was up by 22.5% in January compared to the same month last year. Tanning and leather goods (excluding clothing) grew by 8.2%.

The data comes from the Manufacturing Industrial Production Index (IPI Manufacturing) published monthly by the National Institute of Statistics and Censuses (Indec). Clothing saw its IPI go up by 9.1%. The general manufacturing industry was up by 6.3% year-on-year in January.

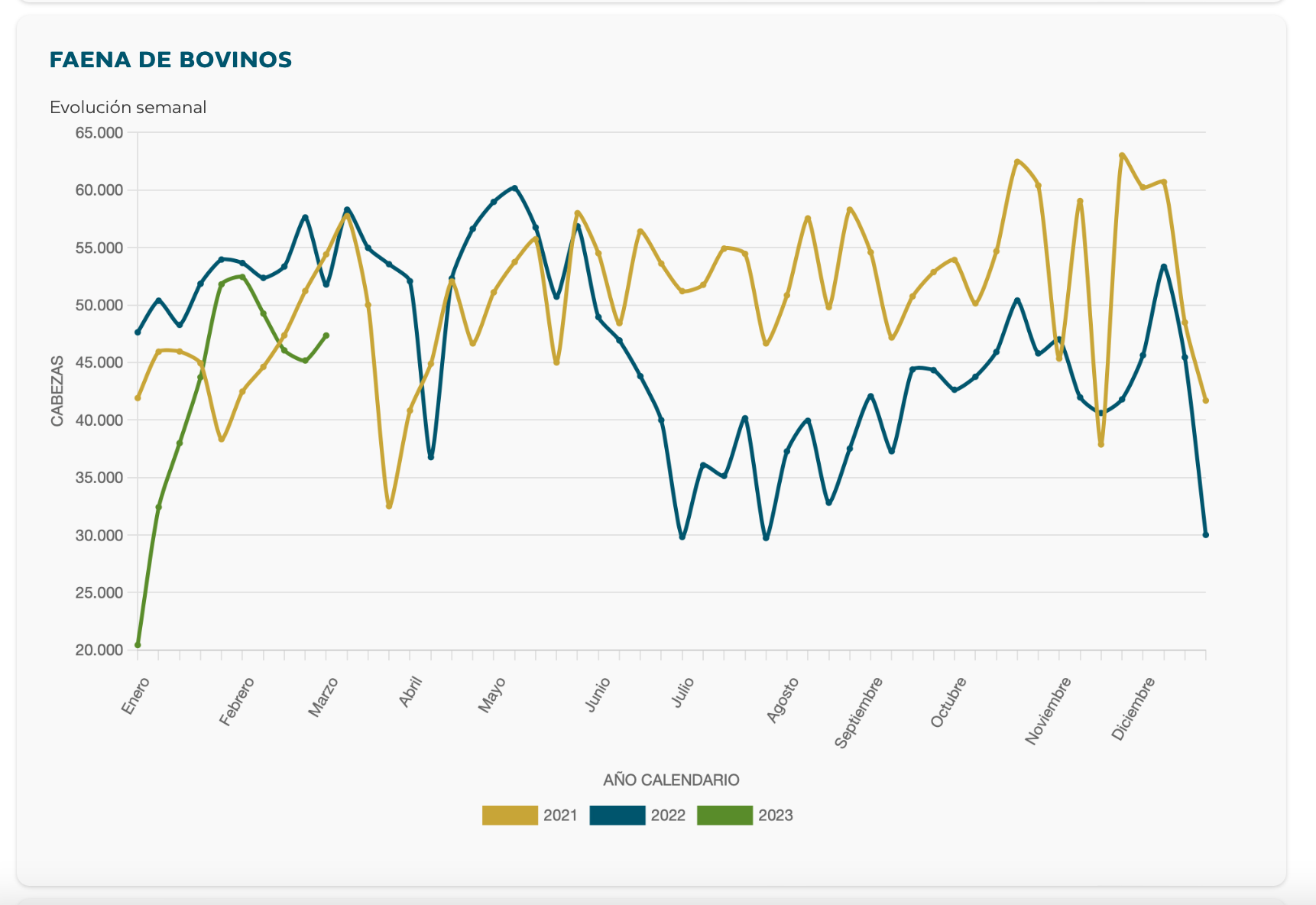

Slaughter, beef production expected to be lower in 2023

USDA/FAS

After three years of dry weather conditions which have challenged the Argentine beef cattle industry, Post estimates that Argentine cattle slaughter and beef production will both drop in 2023, in line with official USDA estimates. If weather conditions begin to normalize in March and April with the end of the La Nina climate pattern, improvements in pasture conditions could permit producers to retain more cattle, potentially leading to higher prices. A reduction in beef output will be reduce both domestic consumption and exports relative to 2022. Post raises its 2023 export estimate to 780,000 tons carcass weight equivalent (CWE), marginally higher than the official USDA number, but 45,000 tons CWE lower than in 2022. China is expected to continue to be the main destination of Argentine beef, accounting for approximately 75 percent of the total

Top slaughter companies lose a little share in February

Valor Carne

The ten largest beef companies and groups in Argentina processed 281,000 head in February, about 50,000 less (15%) than in January. These groups accounted for 27% of the national production, down 1 percent from last month.

Argentina’s total slaughter dropped by 12% month-on-month in February.

![]()

BRAZIL

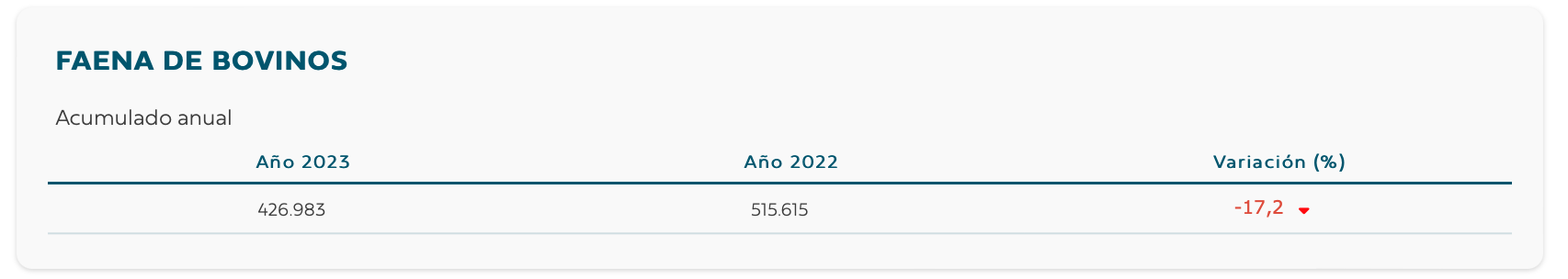

Brazil’s February hide exports lower in value and volume

CICB

Brazil’s February exports of hides and skins totaled a value of US$ 75.4 million, a drop of more 23.9% from the previous month, and 31.3% lower than the same month last year, when US$109.8 million were exported.

The data was presented by the SECEX (Secretariat of Foreign Trade) of the Ministry of Industry and Foreign Trade and analyzed by the CICB.

As for the total exported in square meters, 10.7 million were shipped in February, down 26.2% from January, and 7.3% from February last year, when the total was 11.5 million m2.

The first two months of the year totaled US$174.6 million, 17.5% less than in the same period of 2022, but 6.6% more in area, with 25.1 million square meters.

Analysis of Destinations

In the first two months of the year, the three main destinations for Brazilian leather were:

- China (without HK) remains in the lead, with a share in value of 30.0% (previously 33.0%) and 39.7% (44.3%) in area, with a monetary reduction of 6.9 %, but an increase of 13.7% in area;

- United States with a share of 16.2% (16.3%) in value, and with 8.5% (8.2%) in area, showing drops of 27.9% (+22.1%) in value and 14.1% (+39.1%) in area;

- Italy with a share of 14.9% (15.6%) in value, and 18.7% (20.4%) in area, with drops of 23.7% (20.9%) in value and an increase of 15.8% (25.0%) in area.

The three main destinations for Brazilian leather worsened their indexes with the February results, showing that they were the main reasons for the drop in sector exports this month. China and Italy still registered increases in volume, indicating that they may be drivers of growth in the coming months.

Among the TOP 10, some important increases in values and volumes were shown: Thailand (+23.1% and 69.3%, respectively), South Korea (+46.0% and 52.1%) and Taiwan (+7 .7% and +37.7%).

Analysis of Leather and Skin Types

The following variations were recorded in Brazilian exports of bovine hides by stage, in the two-month period, compared to the same period in 2022:

- Wet Blue dropped in value by 13.0% (-6.1%), but increased by 49.4% (+63.2%) in area;

- Scraping WB increased by 6.3% (-8.6%) in value, but decreased by 12.4% (-23.3%) in area;

- Crust had drops of 23.6% (-10.5%) in value, and 13.5% (+3.7%) in area;

- Finished goods decreased 22.1% (+1.8%) in value and 10.3% (+16.3%) in area.

Even with increases in Wet Blue export volumes this month, price reductions led to declines in monetary totals. Among the other types of leather, only Raspa WB shows improvement in value over the same period in 2022.

Salted skins continue to see strong increases in shipments, now more than tripling in value and almost quadrupling in volume.

State Analysis

Highlights among the exports from Brazilian states in the two months of the year were:

- Considering the top ten exporters, now we only have value growth in four states, with the biggest highlight being Ceará, with +71.8%;

- In relation to the commercialized area of the TOP 10, the opposite occurs, with the majority registering increases in area and weight. Considering both items, the biggest increases were in Pará, with +130.6% in area and +135.8% in weight. The two states with decreases in area were Rio Grande do Sul (-16.2%) and Goiás (-23.8%);

- The ranking continues with Rio Grande do Sul in first place in value, while Paraná leads in volume.

Final Considerations

After January registered stability in value and an increase in area compared to the same month of 2022, February saw declines in both indicators. The only increase was in exported weight. Shipments to the largest market, China, continue to be higher in terms of volume in these first two months, but price reductions for Wet Blue leather mean that the total value will be lower compared to the first two months of 2022.

Still with regard to China, the good news released by the international press in recent weeks shows that economic activity grew significantly in the country in January and February, and the official index of production increased in February faster than in any month of the last decade. The announced increases in exports of manufactured goods from the world’s largest industrial park reveal that we may see a resumption in purchases, with positive effects on the leather industry and on domestic exports in the sector.

Brazil’s 2022 cattle slaughter increased by 7.5%

Correio do Povo

After two years of decline in Brazil, cattle slaughter was up in 2022 by 7.5%, totaling 29.8 million head.

Data from the the Brazilian Institute of Geography and Statistics (IBGE) indicates that this was driven 19.1% more females in the slaughter mix. There was also a record in Brazilian exports of beef in natura, estimated at 1.99 million tons.

The numbers reflect the livestock cycles, explained research analyst Bernardo Viscardi. “After a period of retention of cows for breeding, followed by the entry of calves into the market and their consequent devaluation due to the increase in supply, females begin to be destined for slaughter.” Mato Grosso leads the nation in cattle slaughter, with 15.8% of the total.

Brazilian packers losing millions daily during China export suspension

Brazil’s beef packers are losing big during the suspension off sales to China — between $20 and $25 million per working day, according to a report by Reuters.

Agribusiness consultants Datagro Pecuaria data bases the estimate on current beef export prices ranging between $4,800 and $5,000 per tonne.

Brazil voluntarily suspended beef sales to China on Feb. 23 after reporting a case of Bovine Spongiform Encephalopathy (BSE). While the case was determined to be “atypical” and exports could resume, China must formally approve lifting the ban. Brazilian President Luiz Inacio Lula da Silvas is set to visit Beijing at the end of the month and plans to persuade China to lift the ban.

Brazil is China’s biggest provider of beef, making up 40.5% of its beef imports.

Fimec Buyer Project should generate US$ 8.7 million

Assintecal

The Buyer Project should generate US$ 8.7 million at Fimec, 14% more than last year’s edition. The basic industry fair for the leather-footwear sector took place between March 7th and 9th, at Fenac, in Novo Hamburgo/RS, bringing together more than 20,000 professionals from Brazil and 35 other countries.

The Project is carried out by By Brasil Components, Machinery and Chemicals, a program maintained by the Brazilian Association of Components for Leather, Footwear and Artifacts (Assintecal) in partnership with the Brazilian Trade and Investment Promotion Agency (ApexBrasil),

Assintecal International Market manager Luiz Ribas Júnior says out that the estimate includes business carried out in loco along with deals lined up during the business roundtables held at the fair. “The 12 importers who came through the project, carried out more than US$2.5 million in business in loco, in addition to leaving many purchases lined up for the coming months,” Ribas Júnior says. He added that some of the main manufacturers of safety shoes and leather distributors from Colombia, Ecuador, Mexico, Guatemala and Portugal were at the event.

The sector of components and chemicals for footwear and leather is experiencing a special moment with regard to the internationalization of the sector. In 2022, according to data prepared by Assintecal, sector exports generated US$ 421.2 million, 12% more than in 2021. In comparison with the pre-pandemic, in 2019, growth was 18%.

Abicalçados presents at British Footwear event

The Brazilian Association of Footwear Industries (Abicalçados), represented by Project manager Letícia Sperb Masselli, took part in the March 1 Going Global event, promoted by the British Footwear Association (BFA).

The online event also featured a presentation by designer Diego Vanassibarra, a Brazilian based in the United Kingdom who migrated his production from Italy to Brazil in search of creative freedom and comfort.

Masselli presented the potential of the Brazilian footwear industry, which exports more than 140 million pairs to around 170 destinations. It is the fifth largest footwear producer in the world, the largest outside of Asia, she said. Brazil has a complete production cluster, with all the inputs necessary for the manufacture of quality footwear that is comfortable and in line with the concepts of sustainability.

“British manufacturers were positively impacted, mainly with the sustainability of the Brazilian footwear industry, the production flexibility to meet smaller orders and the organization of the cluster,” she said. Maselli also spoke about the platform for connecting business with international buyers BrazilianFoootwear.com and about the only ESG certification program for the footwear production chain in the world, the Sustainable Origin. Letícia pointed out that, on the day of the BFA event, there was a peak in access to BrazilianFootwear.com and that she received three returns from British buyers interested in Brazilian suppliers.

Vanassibarra spoke highlighted the case of his namesake brand, which develops conceptual shoes. He said it was necessary to migrate its production from Italy to Brazil, because in the country considered the birthplace of global fashion, it encountered difficulties with regard to creation, given the lack of flexibility and interest in developing truly innovative and conceptual products. In addition, the designer pointed out that, in Italy, he could not provide the necessary comfort to his product, which he only found when he started to produce in Brazil. “In Brazil, I found problem solvers, willing to find ways to make ideas viable”, he said. Currently, the creator produces in Vale do Sinos, a footwear hub located in Rio Grande do Sul.

The invitation came through Brazilian Footwear, a support program for footwear exports that Abicalçados maintains in partnership with the Brazilian Trade and Investment Promotion Agency (ApexBrasil).

“Asian invasion” affecting employment in footwear sector

Abicalçados

The invasion of Asian footwear, especially from China, is already having undesirable effects on the level of employment in the footwear industry.

In January, the sector created only 1,300 jobs throughout Brazil, the worst balance in 14 years. According to data prepared by the Brazilian Association of Footwear Industries (Abicalçados), the average balance in the last two years for January was 8,000 vacancies created. The footwear industry ended the first month of 2023 with 297,700 people employed.

Abicalçados Executive President Haroldo Ferreira warns that Chinese imports have caused unfair competition in Brazilian retail, as they arrive at prices far below those practiced in the market. More recent data from Abicalçados shows that in February, imports totaled 4.37 million pairs and US$37.72 million, up 73% in volume and 32.8% in revenue compared to the same month of 2022. In the two months, total imports were 7.6 million pairs and US$ 86.8 million, up 49% and 65.5%, respectively, compared to the same period last year.

China: footwear at US$1.72

Last month, almost 3 million pairs from China entered Brazil (almost 70% of the total imported). With an average price of just US$1.72 per pair (the lowest since 1997), imports from there totaled US$5 million. The highs are 130.7% in volume and 9.7% in revenue compared to the same period last year. ]

“Clearly there is a dumping process – when the price practiced for export is different from that practiced in the internal market — which creates unfair competition with the Brazilian industry. It is an issue that we are seeking to resolve with the authorities and that, as the data prove, is already reflected in the level of employment,” Ferreira warns, noting that the invasion of Chinese shoes could cause a “crash” in the sector, generating a wave of layoffs. “Without demand, the national industry will stop producing, which results in the unemployment of people from the activity,”

With the February result, Chinese imports totaled 4.32 million pairs and US$11.44 million, increases both in volume (+66%) and in revenue (+21.2%) compared to the same two months of 2022. Since China made the Covid Zero policy more flexible and returned with an appetite to the market at the beginning of the year, footwear manufacturers have been encountering problems.

More Asia on the list

The second origin of imports, in volume, for February was Vietnam. The country sent 764,250 pairs for US$18.15 million, up 6% in volume and 39.2% in revenue compared to February 2022. In the two months, Vietnamese footwear imports totaled 1.9 million pairs and US$44.26 million, higher both in volume (+63.5%) and revenue (+96.5%) compared to the same period last year.

The third origin of Brazilian footwear imports also came from an Asian country. In February, Brazil imported 368,940 pairs from Indonesia for US$7.54 million, up 58.3% in volume and 60% in revenue compared to February 2022.

![]()

CHILE

Retail imports low, but clothing and footwear higher in 2022

Chile’s volume of retail imports in the fourth quarter of 2022 fell to 20.7% in the quarterly comparison and plummeted to 40.6% with compared to the same period in 2021. The indicator ended the 2022 fiscal year with a 12.9% drop in the volume imported by retailers.

According to the National Chamber of Commerce and Tourism (CNC), the sharp annual drop in imported volume is partly due to a high comparison base given the high volumes imported during 2021 in response to the high demand triggered by withdrawals and tax aid.

By category, fashion imports were negative in both the monthly and annual comparisons. Specifically, the apparel and footwear divisions in Q4 were down by 31.3 and 38.3% in their import volume compared to the third quarter. Meanwhile, the slowdown at the annual rate was 33.3 and 26%, respectively.

Still, both categories concluded the year on the rise, with a growth of 21.3% for clothing and 18.2% for footwear.

![]()

COLOMBIA

Cúcuta and Brazil cooperate to innovate in the footwear industry

Semana

The Mayor’s Office of Cúcuta, through the Secretariats of Development and Banco del Progreso, supported the participation of 16 businessmen from the leather, footwear and related sectors, in the 46th edition of the International Fair of Leather, Chemical Products, Components, Machinery and Equipment for Footwear and Tanneries (Fimec), held in Novo Hamburgo, Brazil, last week between March 7 and 9.

“It was a very positive meeting because our businessmen were able to establish commercial alliances with suppliers from Brazil to be at the forefront of new trends and to be able to have a supply directly and without intermediaries, said Michelle Picón, secretary of Banco del Progreso. Business people also had the opportunity to learn about the tanning process, due to the space given by the Institute of Leather and Environment Technology, Senai.

Picon met with the mayor of Novo Hamburgo, Fátima Daudt, and the secretary of Social Development, Mauricio Aguas with the aim of signing an agreement to enable the establish a strategic alliance on footwear issues.

The alliance “Meeting of the Capitals of Footwear” will have the objective “to transfer experiences of relations, knowledge, and generate periodic meetings between the two cities to show the potential of the footwear sector,” said Aguas Sánchez, who added that the agreement should be signed by the end of the first semester.

CUBA

Santiago de Cuba footwear industry seeks investment from China

Ciber Cuba

A state company from Santiago de Cuba wants to revitalize the footwear industry in the province with the help of investments from China.

The Combell Footwear Base Business Unit (UEB) wants to “establish an agreement for the supply of raw materials” with China. The lack of raw materials is “the greatest difficulty for light industry today, which lacks many resources such as threads, mounting templates, fabrics and needles.”

The scarcity of these materials is due to “the global economic crisis and the intensification of the US blockade against Cuba.” According to ACN, faced with these circumstances, the Santiago UEB “bets on new services and productive chains with forms of non-state management to acquire materials.”

With 268 workers on its payroll, the state company has strengthened “the productive link with the military units of the eastern region for the repair of Colossus boots and the manufacture of 5,000 women’s shoes for the daily uniform.”

The facility also produces “work boots with national leather and pre-manufactured soles by a small company from Villa Clara and Havana, and saddle sheets provided by a self-employed worker from Camagüey.”

![]()

MEXICO

SAPAL closed 93 companies, 90% of which were tanneries

In the past 2 years, the León Drinking Water and Sewerage System (SAPAL) closed 93 companies, of which 90% are tanneries, for different infractions, according to a report by El Sol de León.

SAPAL director Enrique de Haro, said that while some did not comply with ecological measures, other closures are due to debts, and even some of them are not allowed access to carry out the sampling by the paramunicipal authorities.

For now, they are focused on working with companies in the footwear sector since it is the industry with the highest percentage of sanctions, says de Haro. He said that only 91 companies have signed up for their ecological programs and 200 are missing, some of which have resisted, so SAPAL is taking more drastic measures.