The Week at a Glance

- Brazilian prices lower

- Argentina’s market unchanged

- Paraguay TR1 lower

- APLF presents series of webinars to connect industry

- 1,300 Argentine shoe factories are at risk

- Brazil’s March leather exports down in volume, value

- Central American footwear imports increase

- Léon’s Leather Zone stores turn to e-commerce

- Uruguay slaughter plummets in recent weeks

Click here to read the report in Spanish

![]()

Raw/Fresh Skins

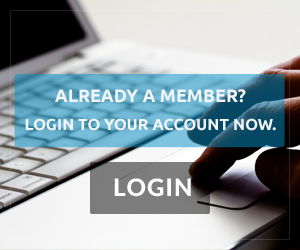

This week in Brazil, the real closed at R$5.2371 against the US dollar compared to R$5.0773 in the previous period. The average price of fresh hides dropped to close at R$0.49 per kilo.

Zebu hides also saw a decline and are selling at R$0.45 to $0.60/kg (with hump) and Gaucho hides also at R$0.45 to $0.60/kg. (without hump). There is one region with slightly varying prices, but in terms of the best sources, this is the price range.

Sources in Argentina say that the situation there is very bad, as the main markets for exports have shut down. Mexico is closed as is Europe and India. Therefore, not only are new orders not arriving, but previous orders are being postponed or canceled. Although China is starting to work, it’s only the factories that produce for the domestic market and the prices offered are much lower than needed.

Some tanneries in the country have closed for several weeks while others are working at 20% or 30% capacity to make some wet blue to keep in their warehouses. Others are only producing what they have to for orders, and that is not much.

The kill remains strong, even considering that some slaughterhouses are closed due to COVID-19 issues. Still, there are no prices. Some people may be getting hides for free and others paying for some categories.

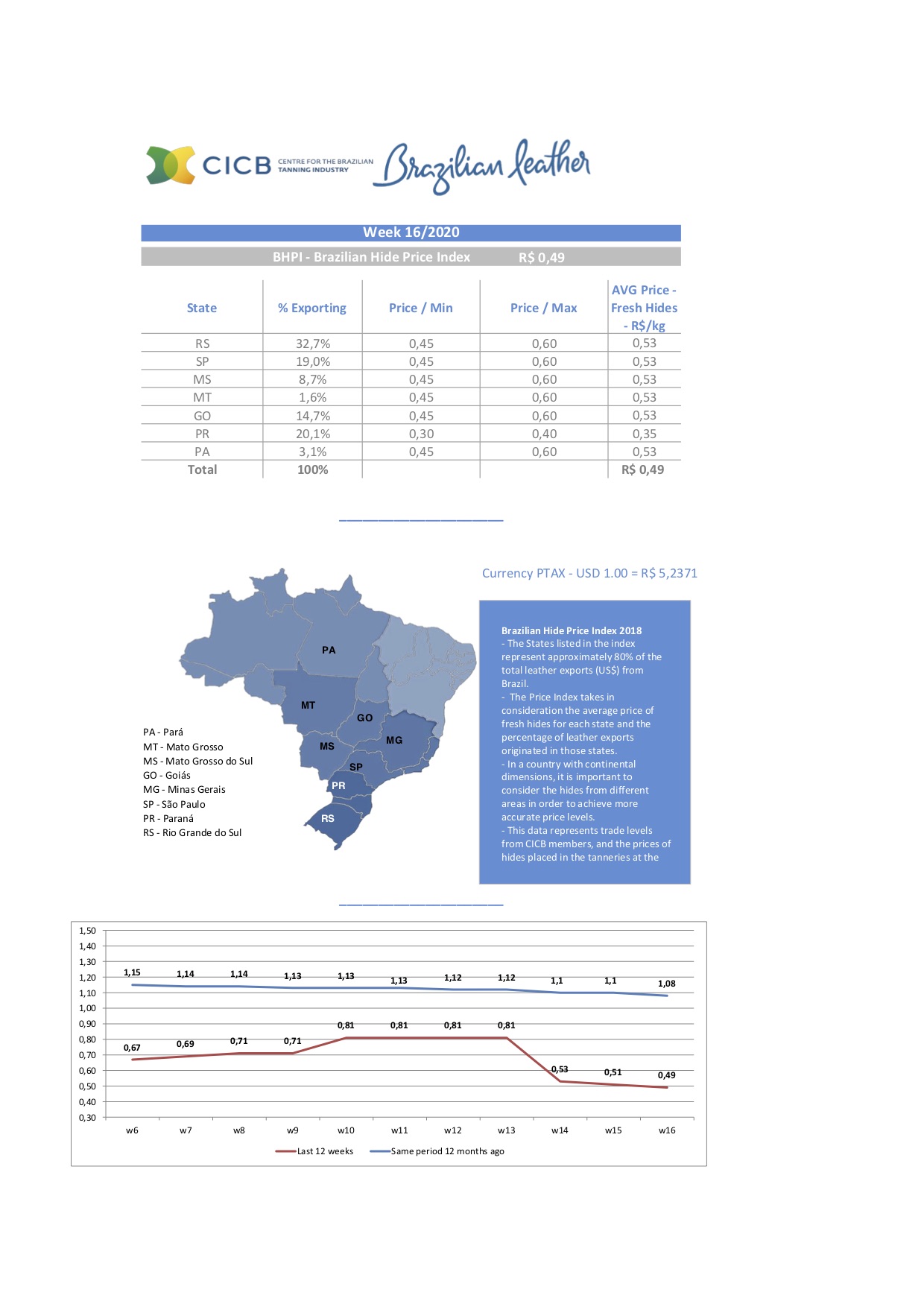

In Uruguay, INAC reports that slaughter dropped by 20.3 percent but for the month of April, the total number has plummeted by 70 percent due to several factors. See the expanded report in Industry News below.

Wet Blue & Crust

Brazil’s domestic market was unchanged during the week due to the lack of demand. On the global front, the activity of the leather industry and those that use this material for their products is returning in China and other Asian countries. Luxury sales are recovering in China. For example, on the day that the Hermès’s store in Guangzhou reopened, it logged $2.7 million in sales on one day. Guangzhou is the capital of Guangdong province, the richest area in China. In Europe, the resumption begins, albeit at a lower level. Brazil is seeing similar movement, but there is a problem: To whom to sell what is manufactured? This recovery will take a little longer. TR1 is selling at US$0.57/sq ft and extra heavy at US$0.60.

Regarding hide and leather Brazilian exports, in the second week of April, shipments had a daily average of US$3.4 million, well above the US$2.8 million recorded in the previous week.

In Paraguay, everything is slowed by the COVID-19 quarantine so the slaughter in the refrigerators is still reduced. Companies not in the agricultural sector or in its supply chain, are closed. New leather business is not strong and the offering is TR1 at US$0.62/0.65, TR2 at US$0.52/0.55 and TR3 at US$0.45.

![]()

PRICES IN BRAZIL

WEEKLY PRICES PER US$/CFR (except raw material)

| FRESH HIDES US$/Kg | This Week | Last Week |

| US$0.09 | US$0.11 |

| WET BLUE WHOLE HIDES FULL SUBSTANCE | This Week | Last Week |

| Grade TR1 23Kgs+ | 0.53 | 0.57 |

| Grade TR2 22Kgs+ | 0.43 | 0.57 |

| Grade TR3 21Kgs+ | 0.33 | 0.37 |

| Grade TR4 19Kgs+ | 0.25 | 0.27 |

| WET BLUE WHOLE HIDES 20 mm+ | ||

| Grade TR1 47/52ft | 0.43 | 0.47 |

| Grade TR2 47/52ft | 0.33 | 0.37 |

| Grade TR3 45/50ft | 0.25 | 0.30 |

| Grade TR4 45/50ft | 0.20 | 0.25 |

| WET BLUE SIDES 24mm+ | ||

| Grade AB 22/26ft | 0.46 | 0.50 |

| Grade C 22/26ft | 0.46 | 0.40 |

| Grade D 22/26ft | 0.26 | 0.30 |

| Grade E 20/26ft | 0.20 | 0.20 |

| Grade F 20/26ft | – | – |

| WET BLUE SPLITS | ||

| 6/9 Kgs (Glove standard) | 0.25 | 0.25 |

| 7/10Kgs | 0.30 | 0.35 |

| 10/12Kgs | 0.40 | 0.45 |

| 14 kg+ | 0.55 | 0.55 |

| CRUST ( UPHOLSTERY ) 0.9/1.1 mm Stucco & Buffed | ||

| TR 01 | 0.73 | 0.75 |

| TR 02 | 0.63 | 0.65 |

| TR 03 | 0.53 | 0.55 |

| CRUST ( AUTOMOTIVE O&M ) 0.9/1.1 mm | ||

| TR 01 | 0.87 | 0.90 |

| TR 02 | 0.77 | 0.80 |

| TR 03 | 0.67 | 0.70 |

| CRUST ( AUTOMOTIVE O&M ) 01.1/1.3 mm | ||

| TR 01 Vacuum Dry | 1.02 | 1.05 |

| TR 02 Vacuum Dry | 0.92 | 0.95 |

| TR 03 Vacuum Dry | 0.82 | 0.85 |

| CRUST SIDES FOR SHOE UPPER BLACK DYED THRU | ||

| ABC 12/14 mm 14/16 mm | 0.87 | 0.90 |

| D 12/14 mm 14/16 mm | 0.77 | 0.80 |

PRICES IN ARGENTINA

Buenos Aires

| Steers | $0.05 |

| Cows | NA |

| Heifers | $0.10 |

| ARGENTINA | This Week | Last Week | |

| Raw hides (W/S) | |||

| Steers | 0.05 | 0.60 | |

| Cows | NA | 0.10 | |

| Heifers | 0.10 | 0.80 | |

| Crust for shoe upper, 1.2/1.4 mm, black dyed thru* | ABC | 1.85-2.00 | 1.85-2.00 |

| CDE | 1.45-1.55 | 1.45-1.55 | |

| Crust whole hides for upholstery 0.9/1.1 mm** | Auto | 1.35-1.50 | 1.35-1.50 |

| Furniture | |||

| Wet blue drop splits, average 9/11 kg, selection TR*** | Auto | 0.95-1.05 | 0.95-1.05 |

**Usually for full grain selections.

*The selection composition determines the price.

Prices in Uruguay

| Fresh | US$0.15 |

| Salted | US$0.25 |

| Wet Blue 14/16 TR1 | US$0.90 |

| Wet Blue 14/16 TR2 | US$0.70 |

| Wet Blue 14/16 TR3 | US$0.60 |

| Crust 10/12 TR1 | US$1.10 |

| Crust 10/12 Auto | US$1.30 |

| Crust 10/12 Auto (Vacuum Dry) | US$1.50 |

We remind readers that all price tables are intended as a basis to illustrate trends. Our prices quoted do not reflect quality changes present between one and the other source. Hidenet.com recognizes that there is a variety of factors able to determine different prices for similar materials.

INDUSTRY NEWS

GENERAL

APLF presents series of webinars to connect industry

Given the challenges related to the pandemic, ALPF has established a number of online tools for connecting industry members during this uncertain time. A series of webinars is one of the tools being presented. Experts and professionals from different industries will focus on Sustainable Fashion, Technology, Trends Forecast, and Hides & Skin Production.

In April, two webinars are planned, and you can see all the online events here lekarna-slovenija.com.

Beef and Leather in Latin America: Eliminating Deforestation from Supply-Chains

Presented by Mauricio S. Bauer

Moderated by Rafael Andrade

National Wildlife Federation

21 Apr 2020 | 7-8 pm HKT (check your time zone)

International Wildlife Conservation is the international program of the National Wildlife Federation. With over 30 years of experience, the International Wildlife Conservation program combines expertise in the fields of natural resource economics, remote sensing and GIS, international law, and tropical ecology to advance market-based solutions and public policy to eliminate the loss of tropical forests around the world.

We promote “zero deforestation” agriculture production in the tropics, focusing on the commodities that have the greatest impacts on forests and wildlife, such as beef, leather, soy, palm oil, and biomaterials. Our work also focuses on advancing strong and comprehensive international agreements that protect forests and our climate.

This webinar will be presented in English. Save Your Seat.

How can Digital Design, Artificial Intelligence, Digitalized Supply Chains and Smart Factories Become the Main Strategy for Brands and Suppliers in the Post COVID Era?

Presented by Andrey Golub

CEO of Else Corp

28 Apr 2020 | 5-6 pm HKT (check your time zone)

We expected Fashion, Footwear and Leather to become sustainable in the near future. We talked a lot about adapting Digital Design, Smart Manufacturing, and even Artificial Intelligence to those sectors, but just as an option, a privilege for important and well-structured companies.

We dreamed about Digital Supply Chains, B2B platforms… And now we see how quickly COVID-19 is changing the industry from inside out, making “high-tech strategy” the only way to survive. Are we ready? Do we know and understand well enough the technological landscape? Can we filter the buzz and think of the impact on our business?

This webinar will be presented in English. Save your seat.

ARGENTINA

1,300 Argentine shoe factories are at risk

FashionNetwork.com

Argentina’s 1,300 footwear factories are at risk due to the COVID-19 pandemic, involving more than 60,000 jobs, according to Laura Barabas, manager of the Chamber of Footwear Industry (CIC).

“At least until April 26, 100% of the industry is paralyzed. Factories are not working and neither are the shops, and online purchases are not being sent, ”Barabas told FashionNetwork.com. For the footwear sector, this is a big problem because its product is seasonal and winter products are made in March. Despite some companies’ e-commerce efforts, sales are still difficult.

The CIC is working online with the Argentine Confederation of Medium-Sized Enterprises (CAME), the Argentine Chamber of Commerce and Services (CAC) and the Argentine Industrial Chamber of Clothing (CIAI) on a plan for the gradual restart of the industry, while maintaining strict sanitary protocols.

“We speak with the entire value chain, but the reality is that all that is being done is accompanying companies to receive aid. We are all going to have to give up something financially in order to get out of this situation, ”said the CIC manager.

“We are focusing on obtaining credits to pay salaries, subsidies, interest waivers. All the measures have to do with helping the SME to get through this season,” she added.

Barabas also noted that the sector is worried about a flood of imports as other strapped countries try to export their products.

![]()

BRAZIL

Brazil’s March leather exports down in volume, value

CICB

Hide and leather exports presented by the SECEX (Secretariat of Foreign Trade) of the MDIC, in March 2020 had a total value of US$97.2 million, which is an 18.3% decrease compared to the same month last year, when US$118.9 million were exported. It is also a 0.9% reduction in relation to February, when exports were US $98.1 million.

As for the total exported in square meters, 15.8 million were shipped in March, 13.2% less than in the same month of 2019, and 1.7% less than February, when the total was 16.1 million m2.

There are the following variations in Brazilian exports of bovine hides by stage in the quarter of 2020, compared to 2019:

- Salted with a 34.0% decrease (before -51.3%) in value, but an increase of 34.3% (+ 13.8%) by weight;

- Wet Blue with a reduction of 37.2% (-34.2%) in value and 23.1% (-18.5%) in area;

- WB shave with an increase of 11.3% (+ 20.6%) in value and 12.2% (+ 23.2%) in area;

- Crust with an increase of 9.1% (+ 9.3%) in value and 17.1% (+ 20.4%) in area;

- Finished with a reduction of 9.8% (-8.7%) in value, but an increase of 1.9% (+ 3.9%) in area.

For the first quarter of 2020, these are the results for the three main markets for Brazilian leather.

- China, with a share of 23.5% in value and 30.5% in area, fell by 14.4% in commercialized area (-6.7% in February) and by 18.4% in value (-11.6%);

- USA, with a share of 20.9% in value and 11.4% in area, increased by 22.0% in area (+15.9%) and 10.9% in value (+3.1%) ;

- Italy, with a share of 15.4% in value and 19.2% in area, decreased by 17.1% in commercialized area (-9.2%), and by -31.7% in value (-27.6%).

Among the main destinations, the US remains the only one to show improvements in volumes and imported values. Performance for China and Italy are worsening every month.

Analyzing the other countries considered important players in the leather trade, we highlight the following:

- Vietnam, in fourth place in the ranking (6.3% share value), increased by 42.3% in area and decreased by 9.7% in value;

- Hong Kong, with a share of 4.6% in value, continues with significant growth in area of 51.2%, but a decrease in value of 25.3% (-17.2%);

- Germany, returning to fifth position, now with a 4.6% share, shows a reduction of 25.1% (- 19.5%) in value and 12.5% in area; and, finally,

- Mexico, with a 4.4% share, maintains an increase of 66.6% (+92.0%) in area and 52.3% (+67.8%) in value.

- It is important to highlight exports to Macau, which will become a destination in 2020 for Brazilian leather, being an alternative to enter mainland China, given the problems presented by Hong Kong in recent years.

Brazil’s states show the following highlights:

In an analysis of the ten states with the highest exports in the country, Minas Gerais, which until February showed a recovery in value, now presents stable indexes, with only +0.6%. All others show declines. If we consider commercialized area, four had a positive performance in the quarter, being: Mato Grosso do Sul (+17.3%), Bahia (+13.6%), Minas Gerais (+8.3%) and Pará (+0.6%).

- Still among the ten largest, the most significant drops in value were: Ceará, with -28.1% (before -37.2%); Goiás, with -24.7% (-24.0%); Pará, with -22.9% (-9.2%); Bahia, with -18.6% (-5.1%); Santa Catarina with -18.5% (-14.0%); and Paraná, with -17.1% (-1.2%).

- Despite the drop in value and area, Rio Grande do Sul remains the leader in shipments abroad, with a share of 26.8% and 21.8%, respectively. Paraná remains in second place in value, with a share of 15.1%, but now in fourth in volume, with 12.8%; São Paulo remains in third place, with a share value of 14.4%, and returns to second place in area, with 16.1%; Goiás, therefore, is fourth in value and third in area.

- In this quarter, the highlight in increasing value and exported area goes to Rondônia, which surpassed Rio de Janeiro and occupies the 12th position, with an increase of 319.4% in value and 586.7% in area.

The volumes exported in March are beginning to demonstrate a worrying scenario, where the stability that until then was apparent, starts to give rise to stronger declines, mainly in Wet Blue leather. Raspa WB still maintains growth in value and volume in the quarter, however, in March it had the biggest declines. The growth in the volume of finished and semi-finished leathers, in the latter also in terms of value, started to decrease or even negate, having a strong impact on total exports. The daily average of exports decreased, but the greater number of working days in March favored the total. With the fall of WB, finished leather started to recover its share in value and volume, showing that the stability of exports at this stage still tends to be secure. The indicators of low raw material prices and a valued dollar are no longer determinants for maintaining volumes. Everything becomes a matter of demand. The coming months will be decisive in the year’s results, as tanneries and manufacturing are already feeling the strong impacts of the pandemic.

Minerva cuts slaughter, rotates suspensions

Abrafrigo

Minerva Foods, one of the largest beef producers in Brazil, is already preparing to alternate slaughter operations between the States, in the event of a possible infection by coronavirus in employees that leads to the closing of any unit of the company

“We are all getting ready in case this happens, replacing (slaughtering in) one factory with another, as far as possible,” said Minerva’s Institutional Relations Director, João Sampaio, in a webinar on Tuesday. In addition, Sampaio said that the company reduced the total number of animals slaughtered because preventive measures also led to fewer workers in the units.

“In the factories, we reduced the number of people working and the number of animals that can be slaughtered. We had several plants inspected by the Public Ministry,” he said, without specifying the actual reduction in slaughter.

In the middle of last month, Minerva announced the suspension of slaughter operations in four units in Brazil, as a preventive measure against coronavirus and for logistical issues also related to the disease. Such stoppages, according to the company at the time, would last up to 15 days. The company has a dozen refrigerators in Brazil and units in Argentina, Chile, Colombia, Paraguay and Uruguay, which are part of the subsidiary Athena Foods.

So far, no company employee has tested positive for COVID-19, he said.

French VERT brand has Brazilian origins

Assintecal

Founded in 2004, the VEJA brand, distributed in Brazil since 2013 under the name VERT, is considered one of the brands most concerned with the way its products are manufactured and marketed worldwide.

Innovation, fair trade, social development, transparency and upcycling (reuse of materials) are fundamental themes for a brand that has been produced in Brazil for over 15 years and distributed to more than 60 countries.

Assintecal recently interviewed Beto Bina, coordinator of the brand’s production, about branding, purpose and sustainability.

Bina said that the brand finds everything it needs in Brazil: raw materials, structured factories and a socially responsible and quality workforce. “In 2013, we started commercial operations in Brazil, with the VERT brand. The relationship between the France and Brazil teams is great. Overall the team is multicultural and we really like this mix.”

With regard to the challenge of sustainability, Nina had this to say: “For us it is something natural. Those who follow our work from the beginning know that each collection brings a new material, an innovative technology, or makes improvements to the materials and products in the collection. WE pose our own challenges. Sustainability is a medium in constant transformation. We don’t think it is right to say 100% sustainable, because nothing is 100%. We try to be the best we can, within the existing limits.”

VERT has been working on a Vegan line, which he says is part of the company’s desire to diversify the use of responsible materials, but without losing quality. Currently, the brand works with CWL, a material made from corn and cotton and which has the visual characteristics of leather, in addition to synthetic suede and organic cotton canvas.

“The interesting thing is that although we have 35% of the collection with Vegan products and a growing audience, the sales of these products are proportionately lower than leather products.”

Read the entire interview on the Assintecal website.

Cattle market update

The evolution of beef exports coincides with the improvement in meat quality for the Brazilian consumer. Livestock started to be organized in the mid-90s, when there was an improvement in food security. In 1997, about 50% of beef was of uncontrolled origin. In 2019, the proportion of uncontrolled meat fell to less than 22%. In the same period, exports increased almost 12 times, from 160,000 tons in 1997 to 1.86 million tons in 2019. Export revenue jumped from US$460 million to US$7.6 billion between 1997 and 2019. Also, 60% to 70% of beef production with federal supervision is already boned in the industry itself, reducing the risk of contamination before it reaches the consumer. Last week, industries that work in partnerships and whose slaughter schedules are calm test the market in an incisive way, offering prices much lower than the refrigerators that are with short schedules. There is no expectation of an increase in red meat consumption for the short term.

![]()

CENTRAL AMERICA

Central American footwear imports increase

In the first nine months of 2019, companies in the region bought sports footwear abroad for $42 million, 5% more than reported in the same period in 2018. Imports to Panama, Nicaragua and Guatemala, account for the increase.

Comparing the first nine months of 2018 and the same period in 2019, the total value of sports footwear imports into Central America registered a 5% increase, rising from $39.8 million to $41.7 million.

Four of the six countries recorded year-on-year increases in their purchases. In Panama, imports increased 43%, while in Nicaragua, Guatemala and El Salvador the increases were 25%, 14% and 2%, respectively.

Costa Rica and Honduras were the only markets to register negative variations, which amounted to -20% and -39%, respectively.

From January to September last year the main buyer in the region was Guatemala with $15 million, followed by Panama with $10 million, El Salvador with $7 million, Costa Rica with $5 million, Honduras with $3 million and Nicaragua with $1.1 million.

In the first nine months of 2019, 26% of the value imported into the region came from China, 10% from Vietnam, 5% from Indonesia and 4% from the USA.

China is the market of origin of imports that has decreased the most for the period in question over the past eight years, since in 2012 it represented 47% of purchases in Central America, and in 2019 that proportion fell to 26%.

Central American Data.

MEXICO

Léon’s Leather Zone stores turn to ecommerce

The more than 4,500 tenants in the Leather Zone who had to close their businesses due to the COVID-19 pandemic are offering their products online, reports El Sol de Léon. The website is zonapielleon.com and the Zona Piel León mobile app is available for Android or IOS.

The Leather Zone is made up of more than 22 commercial squares distributed across 85 hectares and is a source of income for thousands of families from León.

![]()

URUGUAY

Uruguay slaughter plummets in recent weeks

Cattle slaughter was the lowest in a very long time at just 16,680 heads, which is 17.7% less than in the previous week’s very low total of 20,269 cattle.

The collapse in the total is due to three factors: a decrease in the supply of livestock, lower production partly due to the Easter holiday and partly due to a meatworkers’ strike that took place April 1 to 8, and lower demand, both internationally and domestically.

If last week’s slaughter (16,680 animals) is compared to that of the same week in 2019, the decrease is a formidable 31.53%.

Always based on official data, so far in 2020 489,520 cattle were slaughtered, 31.3% less compared to the same period in 2019 (then it had reached 712,428 heads). The most intense fall is seen in the cows category, with 38.3%, while in steers the drop is 29.1% and in heifers is 14.9%, to cite the three categories with the highest volume.

Of the slaughtered this year, 46% are steers, 37% cows, 15% heifers, 1.53% bulls and 0.49% calves.